Most Popular Scams To Watch Out For Part 2

Let’s talk about some of the most popular scams to watch out for

Social Engineering, Phishing, and Ransomware

Your employees play a critical role in protecting your company from cyber scams that target your organization through spear-phishing attacks and ransomware. These attacks are becoming more sophisticated and appear to come from someone you know or a trusted source. Employees should use caution when opening emails, visiting websites and responding to requests for personal information or payment. Learn more about how to be cyber safe at home and at work.

Business Promotion and Coaching Scams

Scammers pose as professional business coaches and sell bogus business coaching and internet promotion services. Using fake testimonials, videos, seminar presentations, and telemarketing calls, they falsely promise amazing results and exclusive market research for people who pay their fees. They also may lure you in with low initial costs, only to ask for thousands of dollars later. In reality, the scammers leave budding entrepreneurs without the help they sought and with thousands of dollars of debt.

Changing Online Reviews

In this scam, a company guarantees that it can improve your rating or get negative reviews moved to the bottom of search results. Unfortunately, scammers can’t change what’s already been posted, and no one can guarantee these results. In addition, creating a fake review is not only unethical–but it also violates terms of service agreements for online review sites and may be illegal under certain state laws.

Credit Card Processing and Equipment Leasing Scams

Scammers know that small businesses are looking for ways to reduce costs. Some deceptively promise lower rates for processing credit card transactions or better deals on equipment leasing. These scammers resort to the fine print, half-truths, and flat-out lies to get a business owner’s signature on a contract. Some unscrupulous sales agents ask business owners to sign documents that still have key terms left blank. Don’t do it. Others have been known to change terms after the fact. If a salesperson refuses to give you copies of all documents right then and there — or tries to put you off with a promise to send them later — that could be a sign that you’re dealing with a scammer.

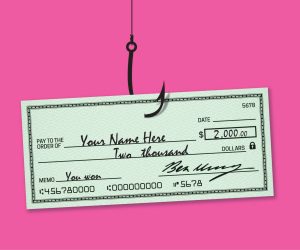

Fake Check Scams

Fake check scams happen when a scammer overpays with a check and asks you to wire the extra money to a third party. By the time the bank discovers you’ve deposited a bad check, the scammer already has the money you sent them, and you’re stuck repaying the bank. This can happen even after the funds are made available in your account and the bank has told you the check has “cleared.”

Since developing Lying Client in 2021, we are dedicated to assisting businesses with protecting their greatest asset: their business! We uncover the scammers that continue to exploit businesses. Learn more about us