How to Respond to a Chargeback Dispute: A Step-by-Step Guide Introduction: Chargeback

disputes can be a headache for any business owner. Chargebacks occur when a customer disputes

a transaction, and the funds are returned to them.

It can be a frustrating and time-consuming process to deal with chargeback disputes, but it is essential to respond in a timely and effective manner.

In this blog post, we will provide you with a step-by-step guide on how to respond to a

chargeback dispute.

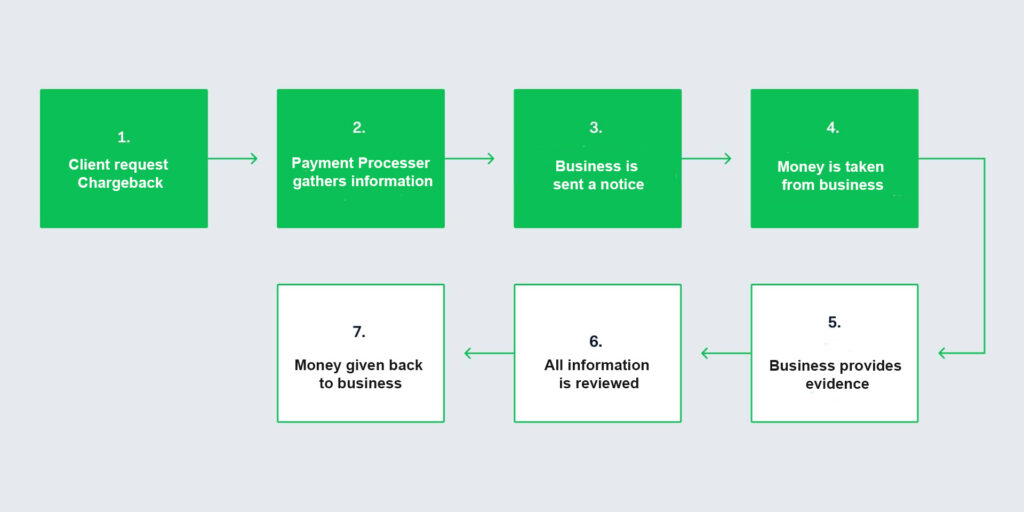

You should first know what a chargeback is. A chargeback is when a payment is reversed after a customer disputes a charge on their account statement.

An example is:

The customer might have received a damaged product. Or maybe the merchant made a

processing error and accidentally charged the customer twice.

In these cases, a customer can file a chargeback with their bank for transactions made on credit or debit cards.

Once approved, the customer receives the transaction amount back in full.

Step 1:

Understand the Reason for the Chargeback The first step in responding to a chargeback

dispute is to understand the reason for the chargeback. This information can be found in the

chargeback notification that you receive from your payment processor.

It is important learn how to respond to a chargeback dispute and review the reason for the chargeback carefully and gather any evidence that you have to refute the claim. What about a refund: Although chargebacks and refunds both involve the return of funds, they’re

very different.

Mostly, customers can ask for a refund directly from the merchant within their refund policy. But

sometimes, the merchant might reject the refund request.

Maybe the merchant claims the product wasn’t damaged on arrival or believes the package was

actually delivered on time. If there’s a difference in opinion, the customer may request a

chargeback.

With a chargeback, the customer contacts the bank (not the business) to reverse the payment.

The chargeback process takes longer and involves a few more stages than a refund. And any fees

associated with a chargeback are significantly higher than a refund.

Step 2:

Collect Evidence to support your case once you understand the reason for the chargeback, you need to collect

evidence to support your case. This evidence can include proof of delivery, customer signatures,

and any communication between you and the customer.

The more evidence you have, the better your chances of winning the dispute.

Step 3:

Respond to the Chargeback After you have collected all the necessary evidence, it is time to respond to the chargeback.

To go one step further, it is important to understand how to respond to a chargeback dispute.

You should respond to the chargeback as soon as possible to avoid any penalties or additional fees.

Your response should include a detailed explanation of the transaction, why you believe the chargeback is

unjustified, and the evidence you have to support your claim.

Step 4:

Wait for the Result After you have responded to the chargeback, you will need to wait for the result. The payment

processor will investigate the dispute and make a decision based on the evidence provided by

both parties. If the decision is in your favor, the funds will be returned to your account. If the

decision is not in your favor, you can consider appealing the decision.

Step 5:

Learn from the Experience Whether you win or lose the dispute, it is important to learn from the experience.

Review the reasons for the dispute and see if there are any areas where you can improve your

business practices to avoid similar disputes in the future.

After you have learned how to respond to a chargeback dispute, it is important to know how to prevent chargebacks from occurring in the first place. Preventing chargebacks is more important than defending them. Even if you win the chargeback defense, it’ll still count against your chargeback ratio.

After you have learned how to respond you need to know how to prevent chargebacks.

Chargebacks can cost businesses both the purchase amount as well as additional fees. Banks and

card networks may also penalize you if your chargeback ratio (the percentage of chargebacks of

your transactions) becomes too high.

Learning how to respond to a chargeback dispute and preventing chargebacks is more important than defending them. Even if you win the chargeback

defense, it’ll still count against your chargeback ratio.

Although you can’t avoid chargebacks altogether, there are ways to lower the amount. Here’s

what to focus on:

- Make returns easy.

- Refund as quickly as possible when the customer requests one

- Have a clear returns policy.

- Provide your email address and phone number on your website and emails so that the customer can easily contact you.

- Get the goods to the customer on time.

- Set a realistic delivery date. If there are delays, let the customer know as soon as possible.

- Refund customers proactively if you can’t provide the goods/services by the expected deliver date

- Track your goods to monitor their delivery date. Ask the customer to sign for the package on delivery for extra security.

- Avoid any miscommunication.

- Ensure the payment descriptor of your bank account is clear and accurate

- Respond to any customer questions quickly

- Alert your customers if a product is out of stock as soon as possible

- Provide detailed product descriptions on your website

- Even if you follow all these rules you may still have a chargeback from a lying client. They can cause bankruptcies and businesses to close.

Three things happen when you get a chargeback, and none of them are good for small businesses.

First, you lose the revenue from the transaction. For upstart merchants operating on thin margins,

this can cut deeply into profits.

Second, you have to pay chargeback fees. These are automatically levied by your acquirer or

payment processor every time you receive a chargeback and can range anywhere from $20 to

$100.

Third, your chargeback rate (your ratio of chargebacks to transactions) goes up. When this rate

exceeds 1%, the card network may force you to enter into a costly and inconvenient chargeback

mitigation program.

Merchants who suffer this fate may be labeled “high risk,” which limits which payment

providers will do business with you.

When fees and overhead are factored in, the average chargeback can cost well more than double

the original transaction amount. This revenue loss, combined with the threat of carrying an

excessive chargeback rate, means that when a chargeback problem gets out of hand it can

quickly spell doom for unprepared merchants.

Keeping safe from chargebacks requires a multilayered approach that addresses the root causes of your chargebacks. To know your root causes, you first have to analyze the data from the chargebacks you’ve received to learn exactly how and why they occurred.

Some true fraud chargebacks may be unavoidable, but anti-fraud tools and strong security

measures can keep them to a minimum. Merchant error chargebacks can be prevented by

addressing the operational errors that led to then. In general, excellent customer service and a

generous return policy can go a long way toward neutralizing disputes.

When a customer reaches out to you with a problem, find a way to resolve it in a way that makes

them happy—if you don’t, there’s a good chance they’ll go complain to their bank instead.

Merchants can fight friendly fraud chargebacks—and beat them—by engaging in chargeback

presentment. This is when you present a disputed charge a second time, along with compelling

evidence that disproves the cardholder’s claims.

It’s important to keep detailed transaction records and save customer correspondence so you can fight back when necessary. One of the best ways to stay safe as a business owner is to join Lyingclient.com

Hopefully this article on How to Respond to a Chargeback Dispute will help business owners to fight against their chargeback disputes

With real time scam alerts, fraud, and chargebacks listed on the website an owner can feel safe.

A background for lying clients is important. Your business is My Business! ™

How to Respond to a Chargeback Dispute